You may be interested in investing in Bitcoin or other cryptocurrencies for any number of reasons. You might be an adventurous investor with money to burn. You might be desperate to increase your nest egg with a high-performing asset. Or perhaps you want bragging rights at the next cocktail party. Whatever your motivation, investors must realize this is a volatile, developing market that some experts call a bubble that could rapidly deflate at any time. You could also lose all your money through fraud or thieves.

The most prudent course of action is to educate yourself about Blockchain and wait before making any type of direct investment. (Read our introduction to cryptocurrencies and blockchain here.) While some investors have seen spectacular gains, there are very serious risks—you could lose every cent.

While a blockchain’s cryptography and tamper-resistant design prevents data being altered, problems can still occur at the endpoints where there is human interaction. The world’s largest Bitcoin exchange filed for bankruptcy in 2014 after half a billion dollars were hacked and more than 200 million has been stolen from Ethereum investors this year.

Nevertheless, if you do want to invest there are several different ways to do so, with varying degrees of risk.

Questions to ask yourself before investing

- Are you investing money that you can afford to lose? Cryptocurrencies and ICOs are unregulated so there is absolutely no protection for your money.

- Are you investing money you won’t need for several years?

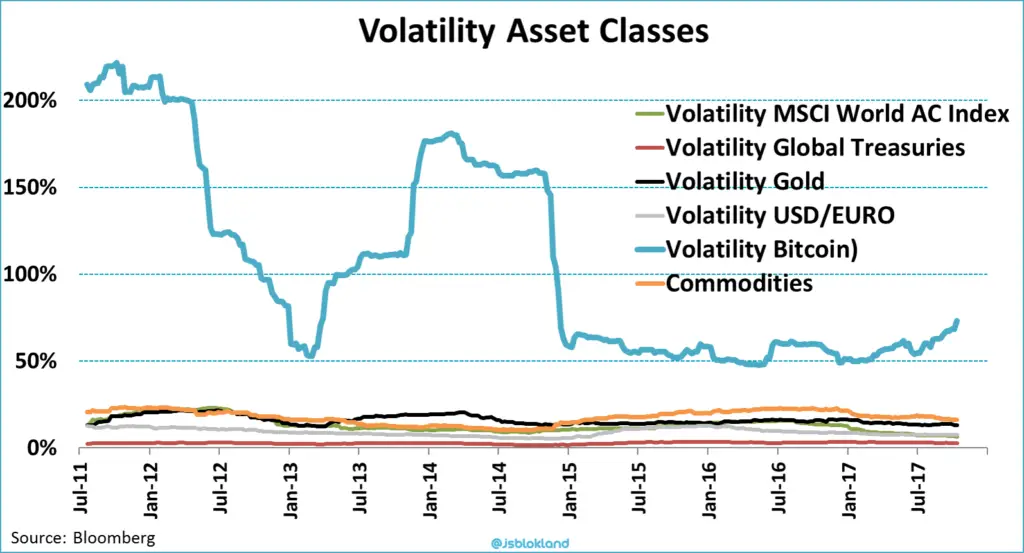

- Can you tolerate risk and a roller-coaster volatility?

- Are you patient?

- Do you know enough about blockchain and cryptocurrencies to make an informed investment?

- What does your financial advisor recommend? And is he or she knowledgeable about blockchain? Ask her to explain how blockchain actually works.

If you do decide you want to get a piece of blockchain’s potential, here are several options.

1. Buy stock in companies that are focused on blockchain.

This is the least risky way to invest in this technology. Many large companies are betting big on blockchain and if it proves profitable for them, your shares could go up. For example, IBM has launched IBM Blockchain which will enable customers to build applications in IBM’s cloud. Seven of Europe’s biggest banks are using IBM’s technology to simplify trade finance transactions. Microsoft is another big blockchain player and its Azure cloud computer service platform supports Ethereum. Most major financial institutions are investing in blockchain as the technology is predicted to save banks $20 billion a year in infrastructure costs.

Obviously, it is less risky to invest in a large, established company like IBM or Microsoft rather than a blockchain start-up. If you’re up for more risk, you may wish to consider blockchain technology stocks recommended by Fintech Investing News.

As with any stock purchase, do your due diligence and consult with your financial advisor if you have one.

2. Buy a cryptocurrency directly.

If you had bought Ethereum on January 1st when it was $8.29 a share, in just six months each Ethereum coin would have been worth $407. But the price quickly dropped and struggled to return to $300 a coin. Bitcoin’s price jumped from less than $1,000 to $6,000 tripled in 2017. So is it too late to invest in Ethereum or Bitcoin, the most popular cryptocurrencies?

The short answer is no one knows. A CoinDesk survey of virtual currency users in June 2017 found 94 percent were positive about the state of Ethereum, while less than half were positive about Bitcoin. There has been some negativity over Bitcoin’s transaction volumes and fees and a growing perception that Bitcoin will be used more for value storage and investment than transactions.

Other cryptocurrencies are valued at much less than Ethereum and Bitcoin so it’s possible they could see bigger gains. On the other hand, if only a few blockchain platforms end up dominating, many blockchains could become nearly worthless (think Facebook beating out MySpace.)

If you’re still interested, you can buy cryptocurrencies on an exchange. You connect your bank account to an exchange and use it to buy coins at a certain price, which will go up and down. Blockgeeks has a good guide to the best exchanges, comparing pros, cons, and fees. Coinbase is a popular, respected exchange that is easy for beginners to use, but it has crashed and delayed transactions when trading volume is high.

If you buy a cryptocurrency directly, your Bitcoin or Ethereum is not protected in the same way a bank guarantees the money in your savings account. You are responsible for protecting your currency and safeguarding it is complex.

And what happens if you’re lucky enough to buy low and sell high? The Internal Revenue Service wants its share. In 2016, the IRS demanded that Coinbase turn over data on every U.S. customer account and detailed transaction records. Coinbase has fought the summons and a judge is expected to issue a ruling sometime in 2017. The IRS has issued tax reporting guidelines and Coinbase provides a report to help with filing taxes.

3. Invest in an Initial Coin Offering (ICO).

Investing in an ICO is even riskier than investing in an established cryptocurrency because there is no track record and often no functional product. It is also riskier than buying stock in a company because securities are highly regulated. ICOs have no regulation and protection for investors. Some people who have invested in ICOs have been scammed and lost all their money. The Securities and Exchange Commission has issued a warning on ICOs, saying at least some should be categorized as securities and follow federal securities laws.

However, if the start-up clearly shows a demonstrated demand, makes sense as a business, and has reputable founders, you may wish to consider it. Blockgeeks has some good advice on avoiding a scam. Cointelegraph provides an ICO calendar that lists ongoing and upcoming ICOs. ICO investors who hope to avoid losses by making informed decisions can turn to Ambisafe Inc., which provides an investment guide to ICOs. Its mission is to ensure high quality standards of start-ups using ICOs.

4. Invest in a cryptocurrency investment vehicle.

With the astounding growth of currencies like Ethereum, financial institutions are creating new types of investment vehicles with the goal of allowing you to profit from cryptocurrencies, without directly investing in one. The problem is that these vehicles may not accurately track currency movements and they can offer big risks. For example, CNBC called the Bitcoin Investment Trust (GBTC) “a disaster waiting to happen.”

The Securities and Exchange Commission is considering whether to allow the first Bitcoin exchange-traded fund to launch after earlier rejecting it due to concerns over regulation.

Any new cryptocurrency investment vehicle is unproven and will include fees that cut into any gains. Right now, there is a lot of sales hype around these investments, but very little objective analysis. It would seem prudent to wait to invest in one until these vehicles have more of a track record.

Whatever your investment goals, now is the time to educate yourself about blockchain and cryptocurrencies. If you’re risk averse, considering investing in a mainstream company that is focused on blockchain. If you have money that you can afford to lose, research cryptocurrency exchanges and ICOs. There is a wealth of information available, so be sure to do your due diligence. Yes, you may make money, but you can also lose it as well.

Related: Bitcoin and blockchain—The dizzying (and controversial) new world of cryptocurrencies

This article is intended to provide an overview of cryptocurrency only. Consult a professional investment advisor to determine whether this is a good investment for you.